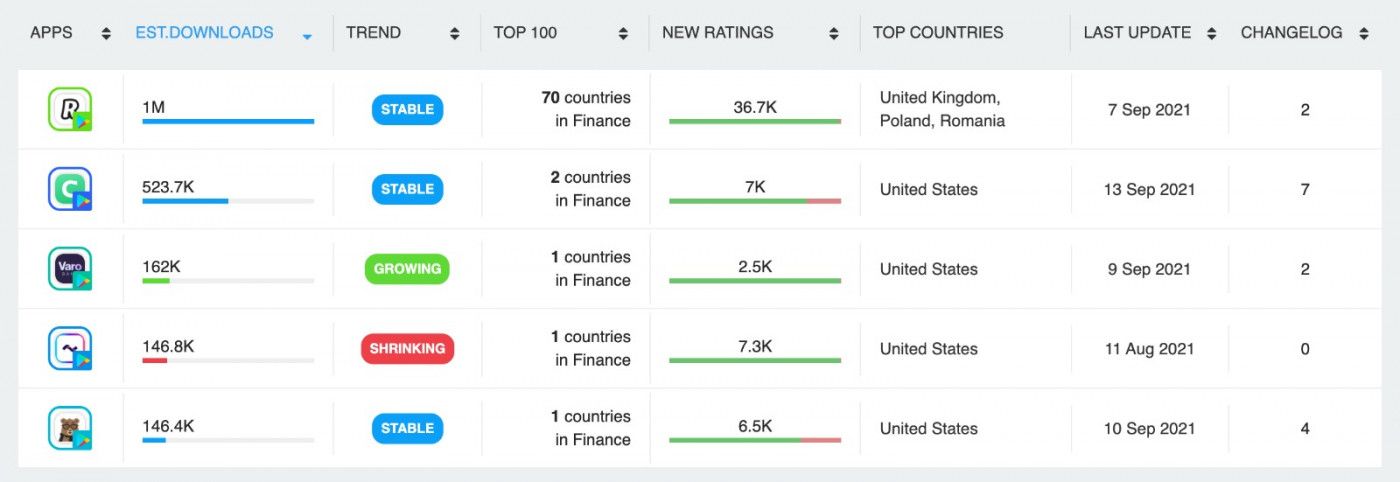

We’ve leveraged our app intelligence solutions to identify the top five neobank apps in 2021 based on downloads. We then compared these neobanks to apps from the top traditional banks based in the United States.

A few weeks ago, we wrote about the continued ascent of neobanks and other mobile banking solutions on our blog, noting that while traditional banking institutions were the first to develop digital offerings, neobanks have lately put the old guard on notice.

In this article, we’ve ranked the top five neobank apps in 2021. We then compared these neobank apps to apps offered by the top five American banks based on total assets.

Here’s what we cover:

Top 5 Neobanks in the United States

1. Revolut by Revolut Ltd

- Short Description: Get more from your money.

- Total Downloads: 10,000,000+

- Downloads Over the Last 30 Days: 1,028,752

2. Chime – Mobile Banking by Chime

- Short Description: Banking with no hidden fees, fee-free overdraft, and early payday.

- Total Downloads: 10,000,000+

- Downloads Over the Last 30 Days: 501,317

3. Dave - Banking for humans by Dave, Inc

- Short Description: Better Banking: up to a $200 advance, find work, manage money, and build credit.

- Total Downloads: 5,000,000+

- Downloads Over the Last 30 Days: 125,189

4. Varo Bank: Mobile Banking by Varo Bank, N.A.

- Short Description: Mobile bank account with no monthly fees, auto savings & direct deposit.

- Total Downloads: 1,000,000+

- Downloads Over the Last 30 Days: 140,691

5. Current - Modern Banking by Current

- Short Description: Get Paid up to 2 Days Faster with Direct Deposit.

- Total Downloads: 1,000,000+

- Downloads Over the Last 30 Days: 123,503

So, that’s the inside scoop on the top five neobank apps. Combined, Revolut, Chime, Dave, Varo Bank, and Current have been downloaded 27+ million times for an average of 5.4+ million total downloads per app. That’s not bad at all, but how does it compare to their traditional banking counterparts?

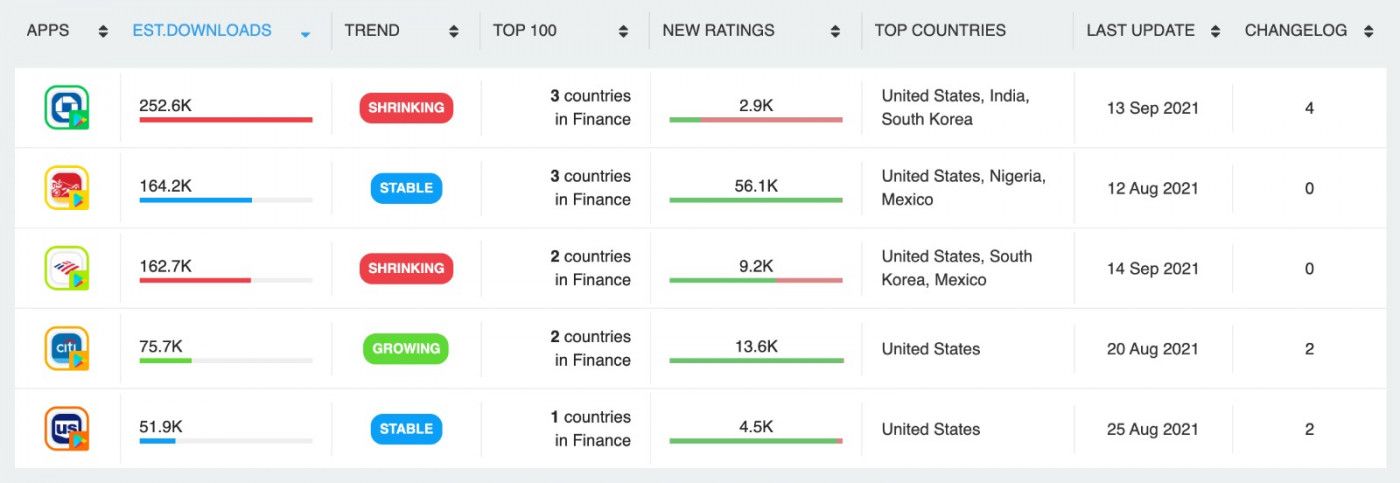

Top 5 Traditional Banks in United States

Below, we’ve pulled together the top five American banks based on total assets. We’ve also leveraged our app intelligence tools to calculate how many times their main apps have been downloaded. Check it out:

1. JPMorgan Chase Bank

- Short Description: JPMorgan Chase & Co. is an American multinational investment bank and financial services holding company headquartered in New York City.

- Total Assets: $3,025,285,000

- Total Downloads for Chase Mobile: 10,000,000+

2. Bank of America

- Short Description: The Bank of America Corporation is an American multinational investment bank and financial services holding company headquartered in Charlotte, North Carolina.

- Total Assets: $2,258,832,000

- Total Downloads for Bank of America Mobile Banking: 10,000,000+

3. Wells Fargo Bank

- Short Description: Wells Fargo & Company is an American multinational financial services company with corporate headquarters in San Francisco, California, operational headquarters in Manhattan, and managerial offices throughout the United States and internationally.

- Total Assets: $1,767,808,000

- Total Downloads for Wells Fargo Mobile: 10,000,000+

4. Citibank

- Short Description: Citibank is the consumer division of financial services multinational Citigroup. Citibank was founded in 1812 as the City Bank of New York, and later became First National City Bank of New York.

- Total Assets: $1,661,507,000

- Total Downloads for Citi Mobile®: 10,000,000+

5. U.S. Bank National Association

- Short Description: U.S. Bancorp is an American bank holding company based in Minneapolis, Minnesota, and incorporated in Delaware.

- Total Assets: $544,774,160

- Total Downloads for U.S. Bank - Secure and easy mobile banking: 5,000,000+

To learn more, download the full report!

Final Thoughts

So, as we concluded in a recent blog post on the topic, even the most popular neobanks lag behind the traditional powers. There’s no shame in that, of course. JP Morgan, BoA, Wells, Citibank, and U.S. Bank have enormous customer bases that have been banking with them for decades. What’s more, while their mobile offerings are already uber-popular, they still have thousands of clients that do not leverage them yet. This means their mobile offerings are likely to keep growing.

Nevertheless, it’s hard to ignore the impact of neobanking. With lower barriers to entry and more convenient customer experiences than brick and mortar institutions, it’s not difficult to imagine a company like Revolut or Chime emerging from the pack as a true competitor. Indeed, considering the demand for democratized and decentralized financial tools, as well as the general trend towards blockchain, cryptocurrencies, and other digital solutions, it’s likely to happen sooner rather than later.

Get Started With 42matters!

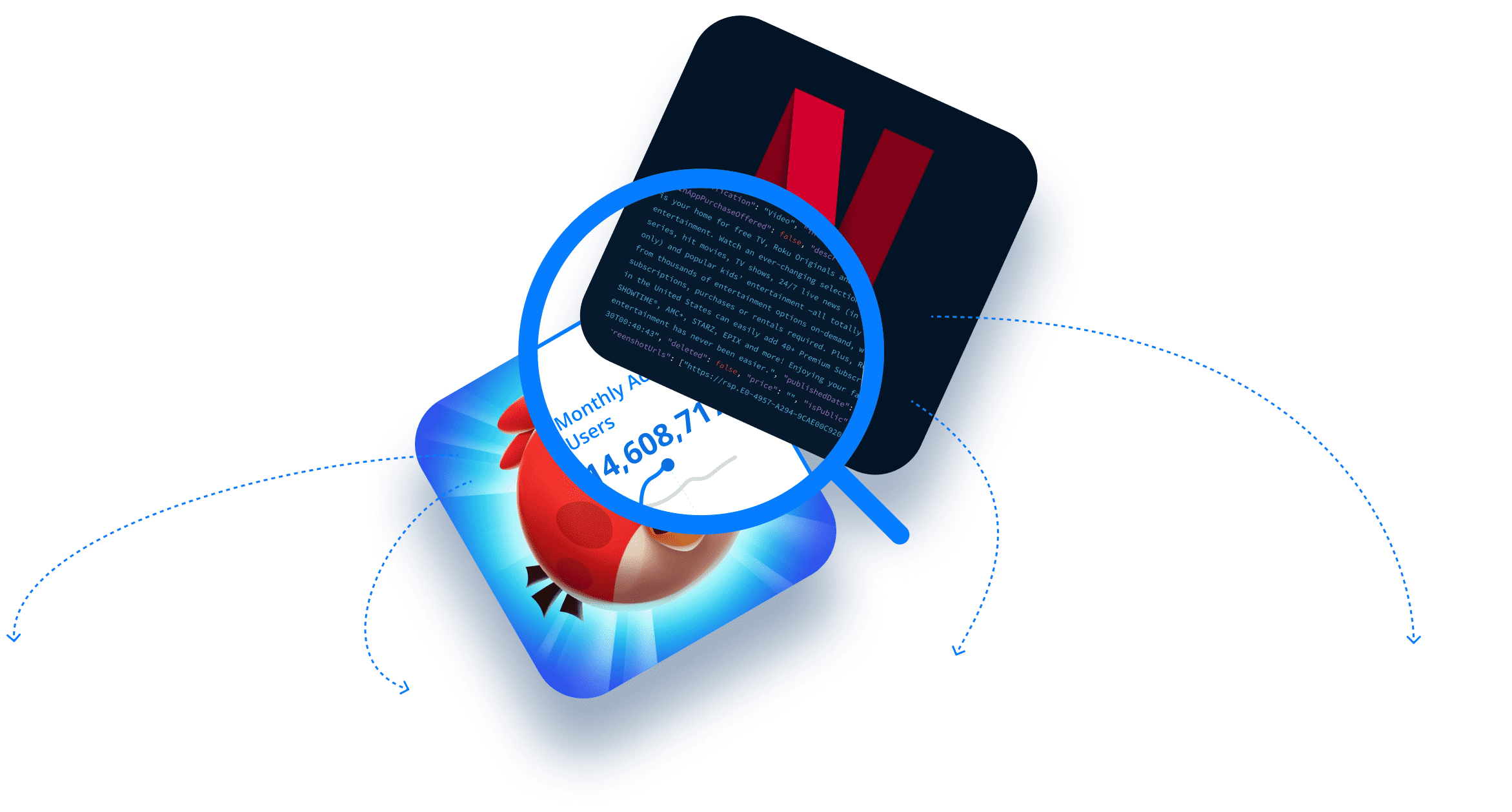

At 42matters, we provide app data, insights, analytics, and competitive intelligence via a host of useful APIs, file dumps, and the 42matters Explorer. This includes:

- Developer details

- Downloads

- Ratings, reviews, and top chart rankings

- Categories, genres, and IAB categories

- Technical insights, including SDKs, permissions, and app-ads.txt

- And more

The 42matters Explorer, which you can try free for 14 days, is an app market research tool that offers a comprehensive look at app trends and statistics. This includes data on both iOS and Android apps.

Moreover, our APIs facilitate programmatic access to app intelligence data from Google Play, the Apple App Store, Amazon Appstore, Tencent MyApp, and a host of connected TV app stores, including the Roku Channel Store, Apple TV tvOS App Store, Amazon Fire TV, Samsung Smart TV Apps, LG Content Store, and Vizio SmartCast Apps.

To learn more about 42matters, schedule a meeting with one of our app market experts. We'll walk you through everything.