We’ve leveraged our app intelligence solutions to identify the top five hyper-casual mobile games in 2021 based on downloads. We then compared these gaming apps using our analytics tools.

Hyper-casual games have long dominated global app stores — and they don’t appear to be going anywhere anytime soon.

Indeed, mobile games now generate nearly 100 billion U.S. dollars in annual revenue. This represents approximately 57.2% of the global gaming market. What’s more, according to the folks over at Statista, ‘Casual’ is by far the most popular gaming genre, with roughly 58.86% of mobile gamers playing ‘Casual’ games.

In this blog post, we take a look at the top five hyper-casual mobile games in 2021. We analyze their download histories, ratings, top chart rankings, changelogs, integrated SDKs, and more!

Here’s what we’ll cover (click the links below to jump to the relevant sections):

- What Are Hyper-Casual Games?

- Top 5 Hyper-Casual Mobile Games in 2021

- Analysis of the Top 5 Hyper-Casual Mobile Games in 2021

- Final Thoughts

What Are Hyper-Casual Games?

Hyper-casual mobile games are free, lightweight gaming apps that are instantly playable and tend to be focused on a single core mechanic, such as directing a vehicle or identifying patterns.

Distinctively, they tend to leverage infinite looping mechanics, which contribute to their highly addictive nature, and snackable content, which make them easy to play while waiting in line at the grocery store or taking the bus to work.

Hyper-casual mobile games have a lot in common with arcade games from the 1970s and ‘80s. They feature simple color schemes, minimalistic user interfaces, and 2D design.

Top 5 Hyper-Casual Mobile Games in 2021

1. Candy Crush Saga by King

- Short Description: The sweetest puzzle game! Switch, match & blast candies to win levels!

- Total Downloads: 1,000,000,000+

- Downloads Over the Last 30 Days: 20,842,724

2. My Talking Angela by Outfit7 Limited

- Short Description: A singing, dancing fashion star from the makers of My Talking Tom!

- Total Downloads: 500,000,000+

- Downloads Over the Last 30 Days: 16,624,749

3. Pou by Zakeh Ltd

- Short Description: Think you have what it takes to adopt a POU?

- Total Downloads: 500,000,000+

- Downloads Over the Last 30 Days: 7,833,277

4. My Talking Tom by Outfit7 Limited

- Short Description: It’s Talking Tom! The coolest cat and biggest superstar in the world!

- Total Downloads: 500,000,000+

- Downloads Over the Last 30 Days: 7,042,282

5. Dumb Ways to Die 2: The Games by Metro Trains Melbourne

- Short Description: The official sequel to the world-famous hit game!

- Total Downloads: 100,000,000+

- Last 30 days Monthly Downloads: 1,210,278

Analysis of the Top 5 Hyper-Casual Mobile Games in 2021

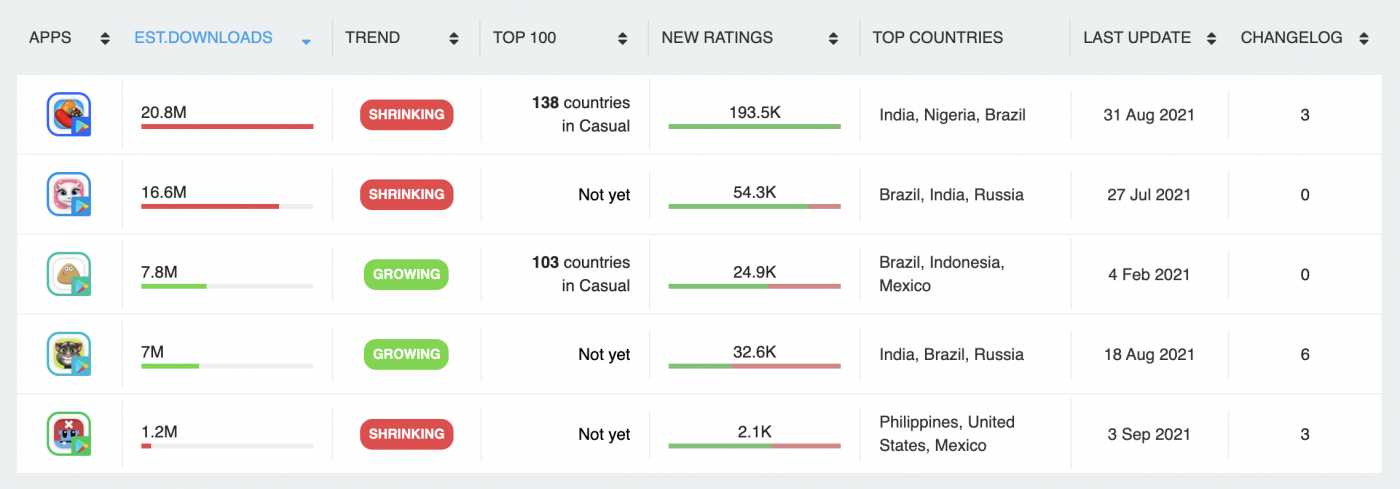

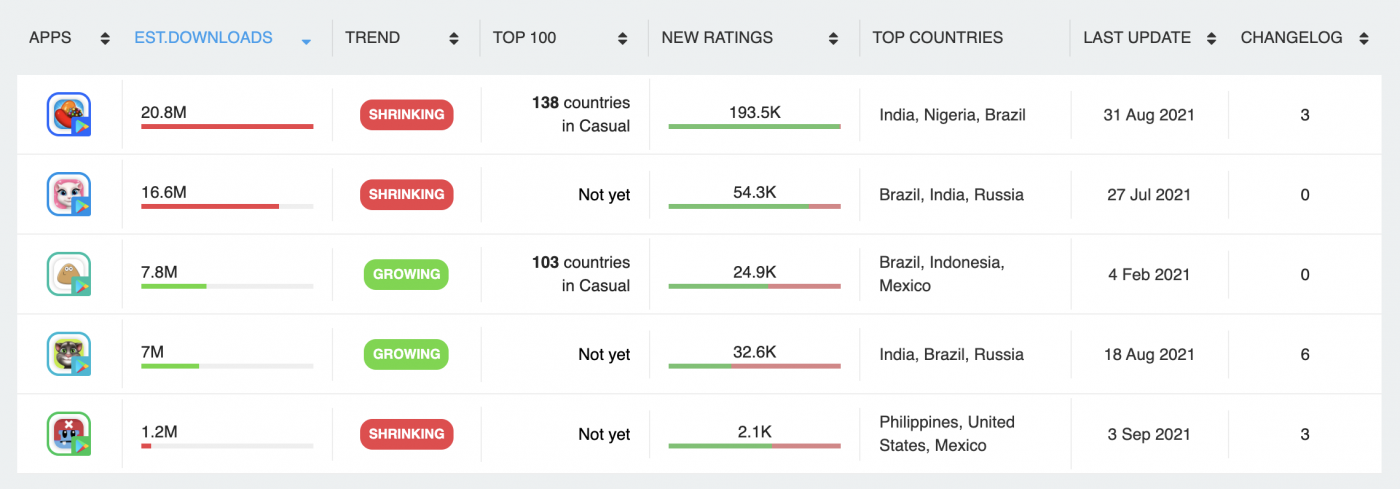

30-Day Performance Summary (August 8th, 2021 - September 8th, 2021)

Here’s a quick glimpse at how these apps have performed over the last 30 days. This chart includes estimated downloads, overall growth trends, top chart rankings, the number of new ratings, top countries, the date of the most recent update, and the number of changes made to the app.

Downloads for Candy Crush Saga easily outpaced those for the rest of the top five, nevertheless, they’re on a downward trajectory. However, the decline is a modest one — Candy Crush Saga remains among the top 100 ‘Casual’ apps in 138 countries. It’s also received a whopping 193,500 new ratings over the last 30 days. In the same period, the developers have made three changes to the app, most recently on August 31st, 2021.

Now, we’ll spare you the point-for-point, app-by-app analysis here. But it’s worth mentioning that despite the success of these games, only two are currently ranked in global top charts: Candy Crush Saga and Pou. The fact that 16.6 million downloads over the last 30 days are insufficient for My Talking Angela to crack the top 100 in any country demonstrates just how competitive the hyper-casual gaming landscape is.

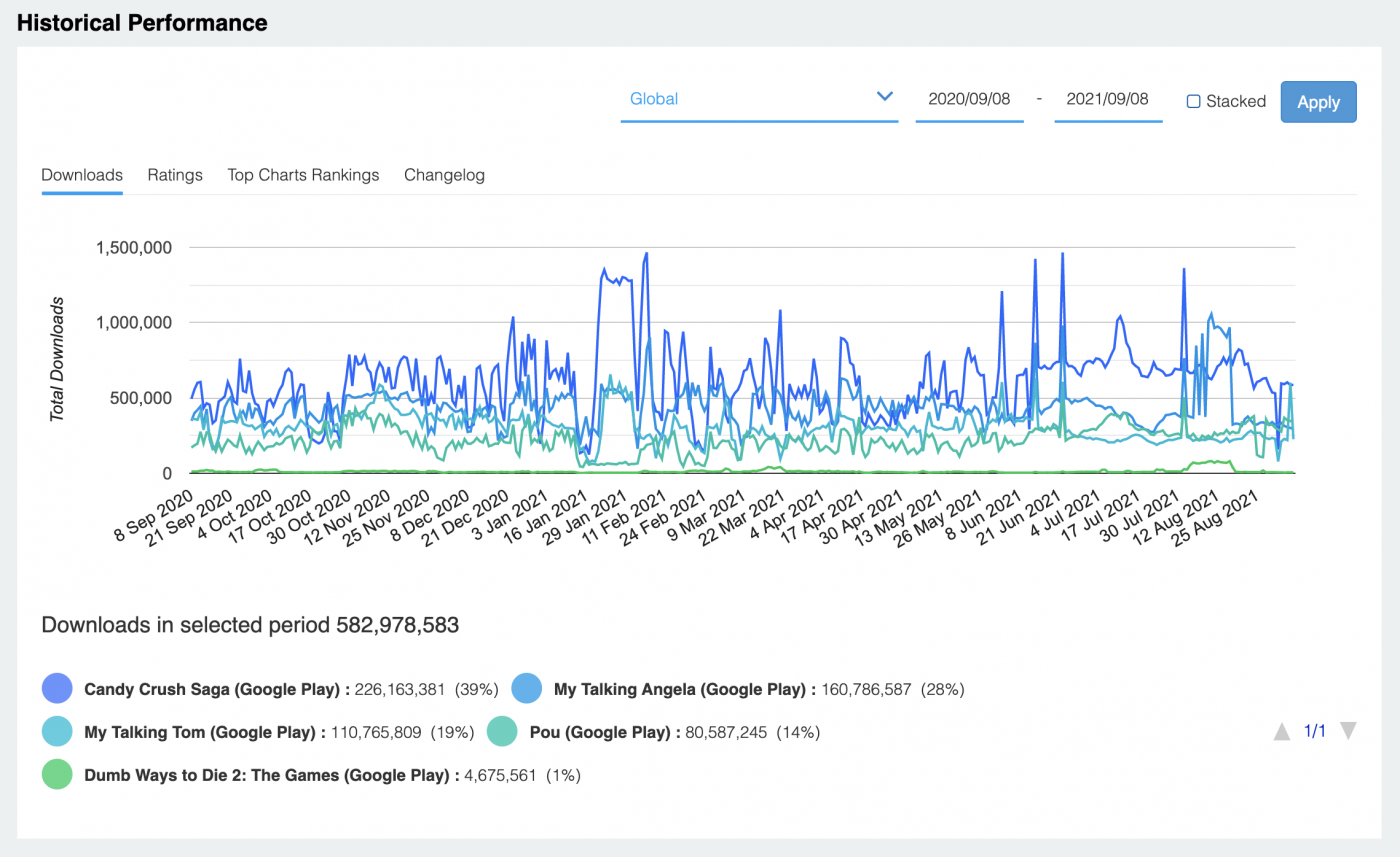

Historical Downloads (September 8th, 2020 - September 8th, 2021)

Next up, let’s take a look at historical downloads. In this case, for the last year.

The first thing that pops out is that Dumb Ways to Die 2 is a clear outlier. With a mere 4,675,561 downloads between September 8th, 2020, and September 8th, 2021, it trails Pou by a full 75 million downloads.

Of course, Candy Crush Saga is once again the “winner,” with 226,163,381 downloads and the most dramatic peaks.

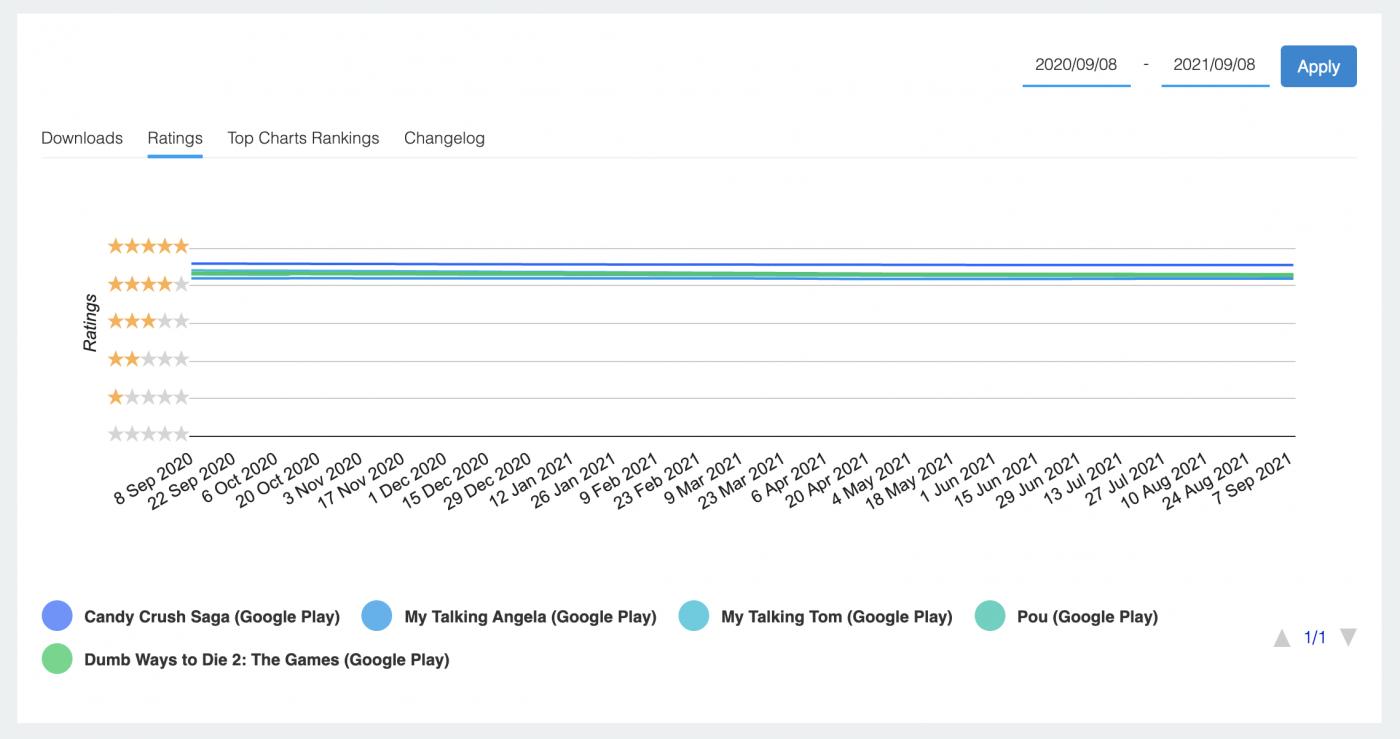

Rating Insights

This graph is pretty straight forward, so let’s not spend too much time here. Each of the top five hyper-casual gaming apps is rated above four stars. If there’s one remarkable take away, it’s that despite having the most downloads and ratings, Candy Crush Saga still manages to break away from the pack just a little bit.

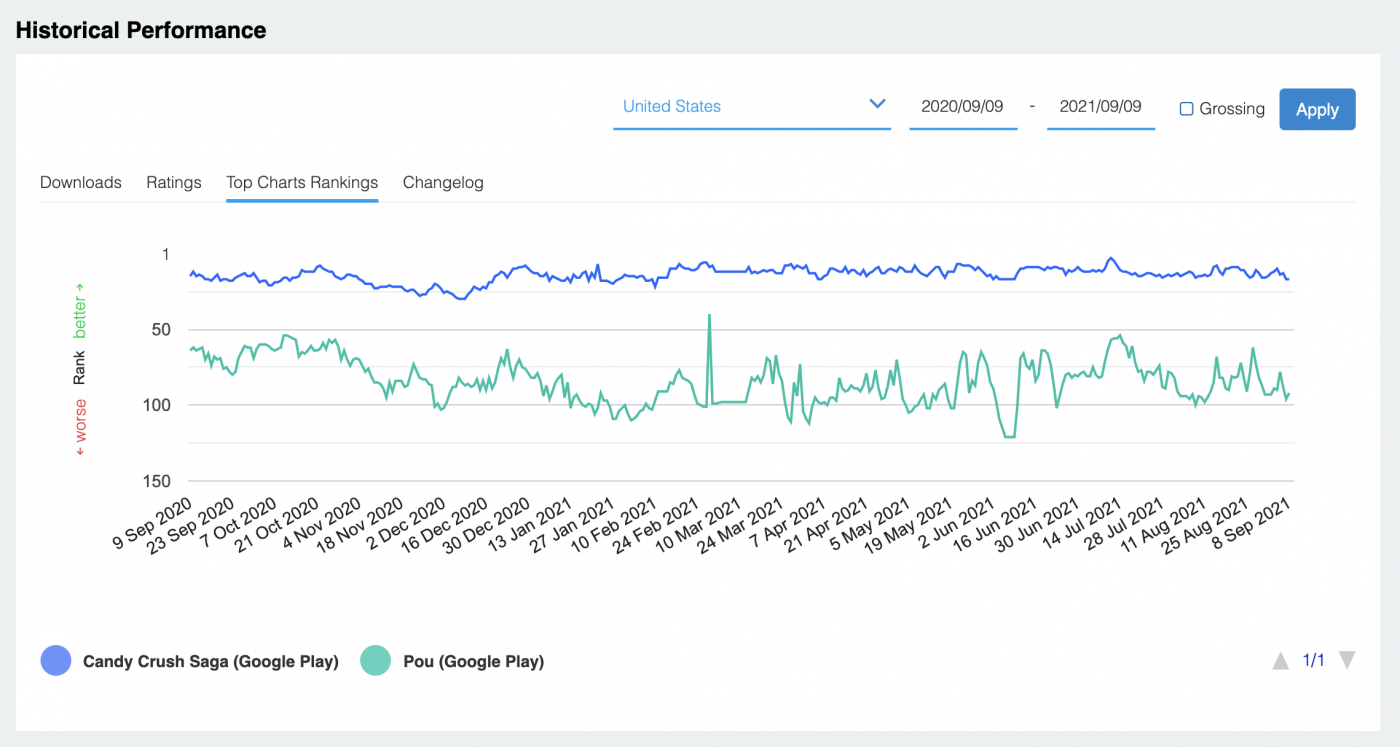

Top Chart Rankings

As noted in the 30-Day Performance Summary section, only Candy Crush Saga and Pou are currently ranked in the global top charts. Indeed, Candy Crush Saga ranks among the top ‘Casual’ games in 138 countries and Pou makes the cut in 103.

This chart, however, is focused on the United States. Over the last year, Candy Crush Saga has never fallen out of the top 50 ‘Casual’ games in the U.S. What’s more, it rarely fell out of the top 25.

Pou’s history is a little more up and down. While it briefly cracked the top 50 ‘Casual’ games in March 2021, it tended to bounce around in the 50-100 range with some forays into the 100-125 range. Still, not a bad outing!

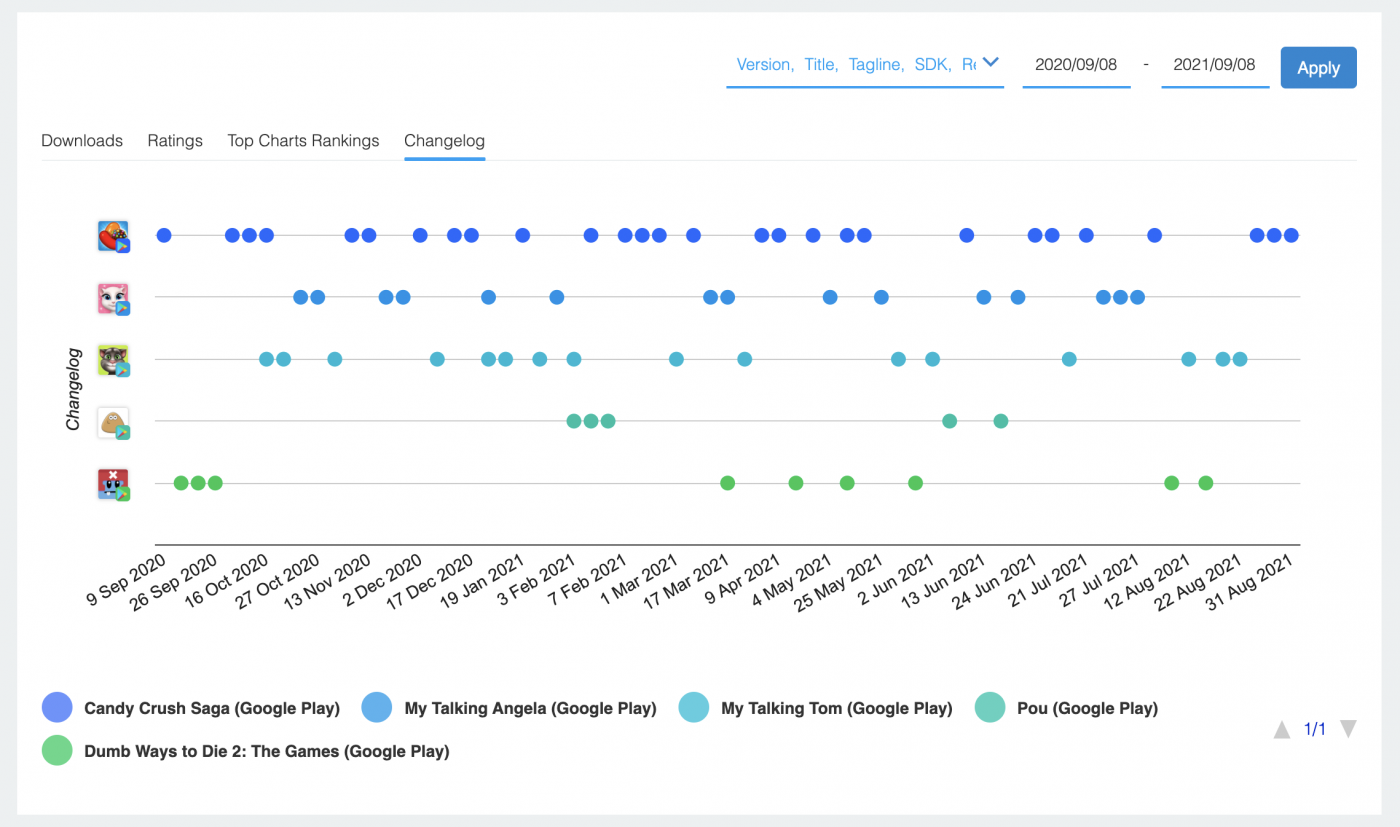

Changelog Insights

Moving on to changelog insights. In this graph, each dot represents an update. These could be anything from a new version release to updated content ratings, to revised taglines, titles, or descriptions.

Unsurprisingly, Candy Crush Saga’s publisher (King), is the most active. They’ve made 28 changes to the app over the last year. On the other hand, Pou’s publisher (Zakeh Ltd) was the least active, making just 5 changes to the app in the same time period.

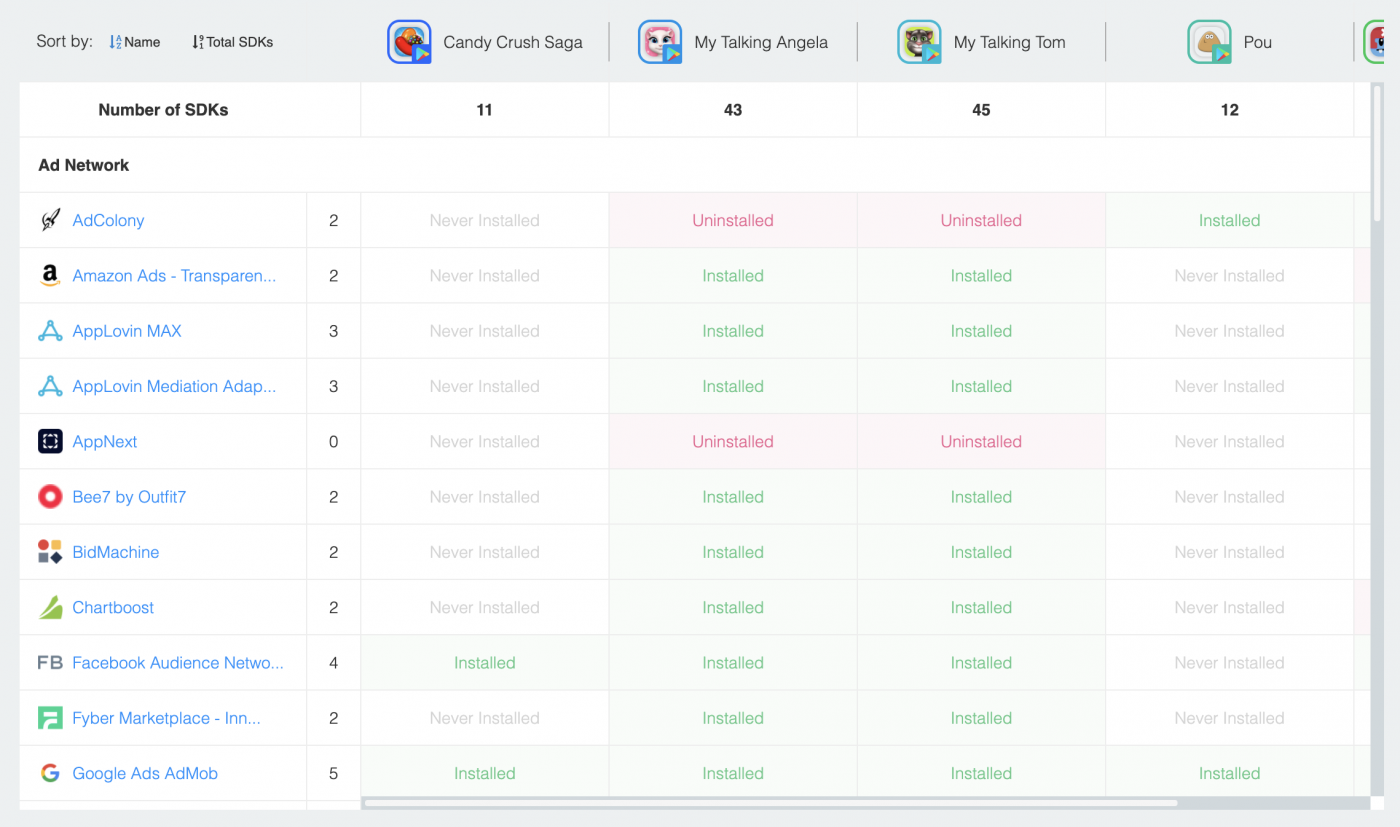

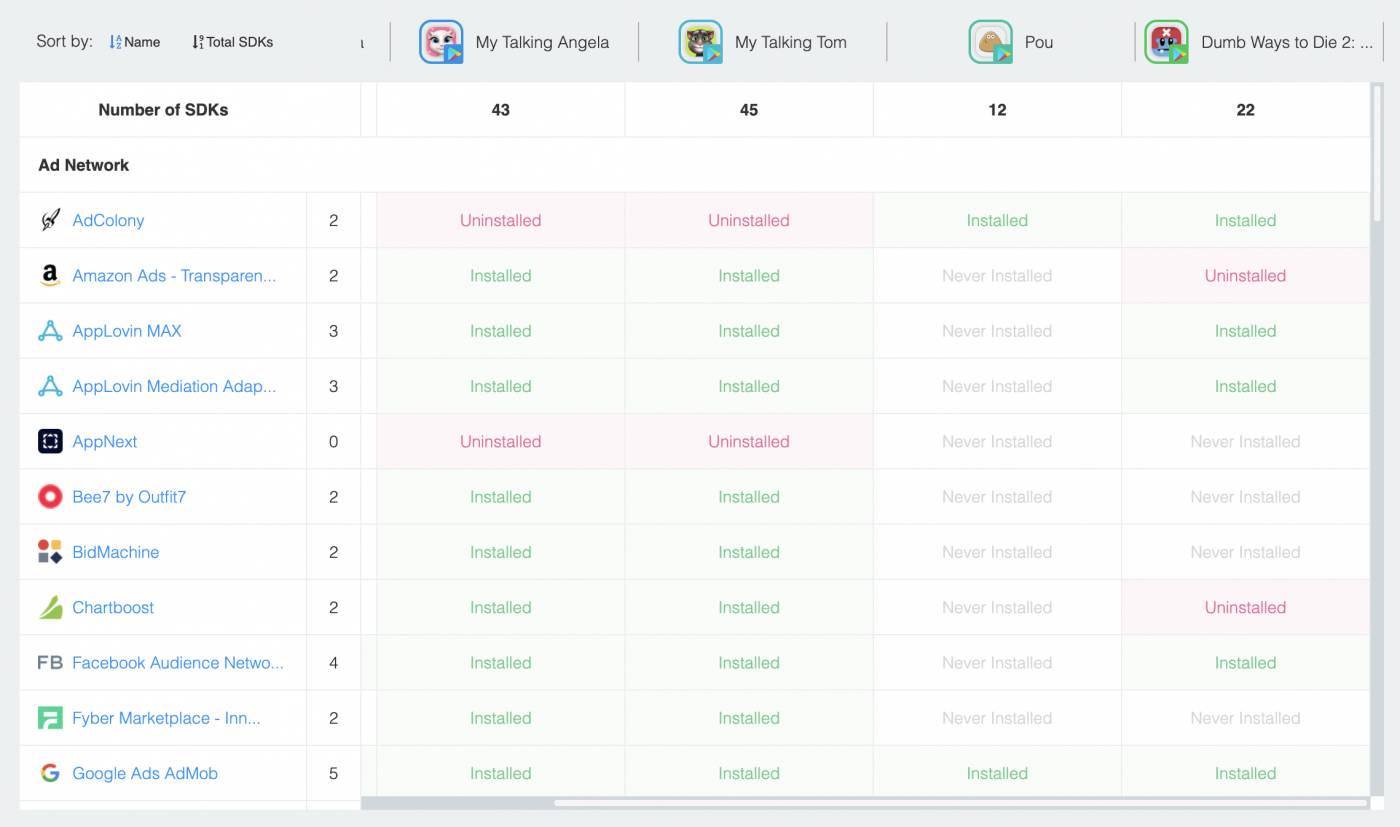

Integrated SDKs

It’s also interesting to compare which SDKs these apps integrate, as well as how many. You may be surprised to hear, for instance, that Candy Crush Saga actually uses the fewest — just 11! On the other hand, My Talking Angela and My Talking Tom, both published by Outfit7 Limited, leverage the most — 43 and 45 respectively.

There’s also a surprising amount of overlap. For instance, all five of the top hyper-casual gaming apps use the Google Ads AdMob SDK, all but Pou use the Facebook Audience Network SDK, and at least three use the AppLovin MAX SDK. In addition, while just two of the top five currently use the AdColony SDK, Amazon Ads SDK, and Chartboost SDK, others have used them in the past.

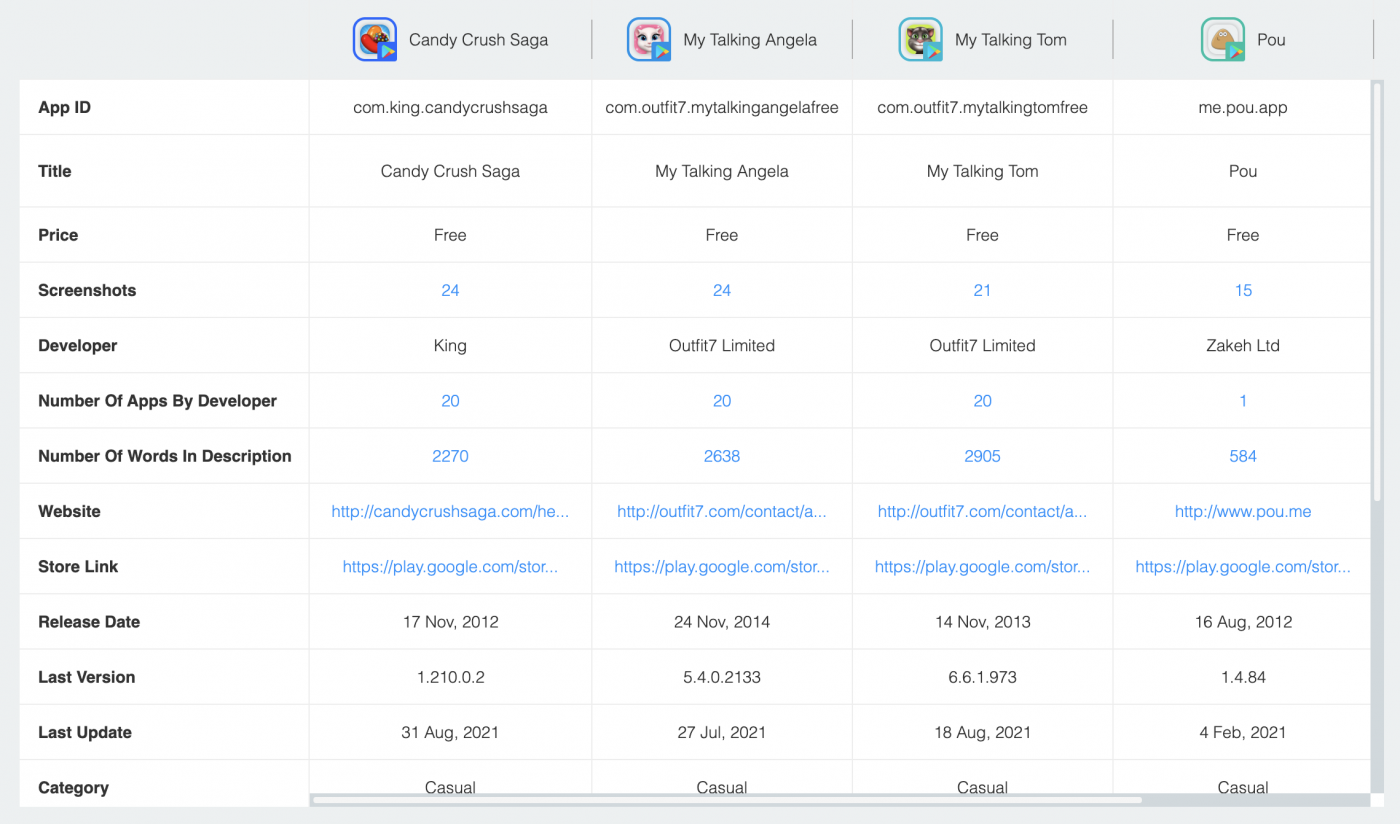

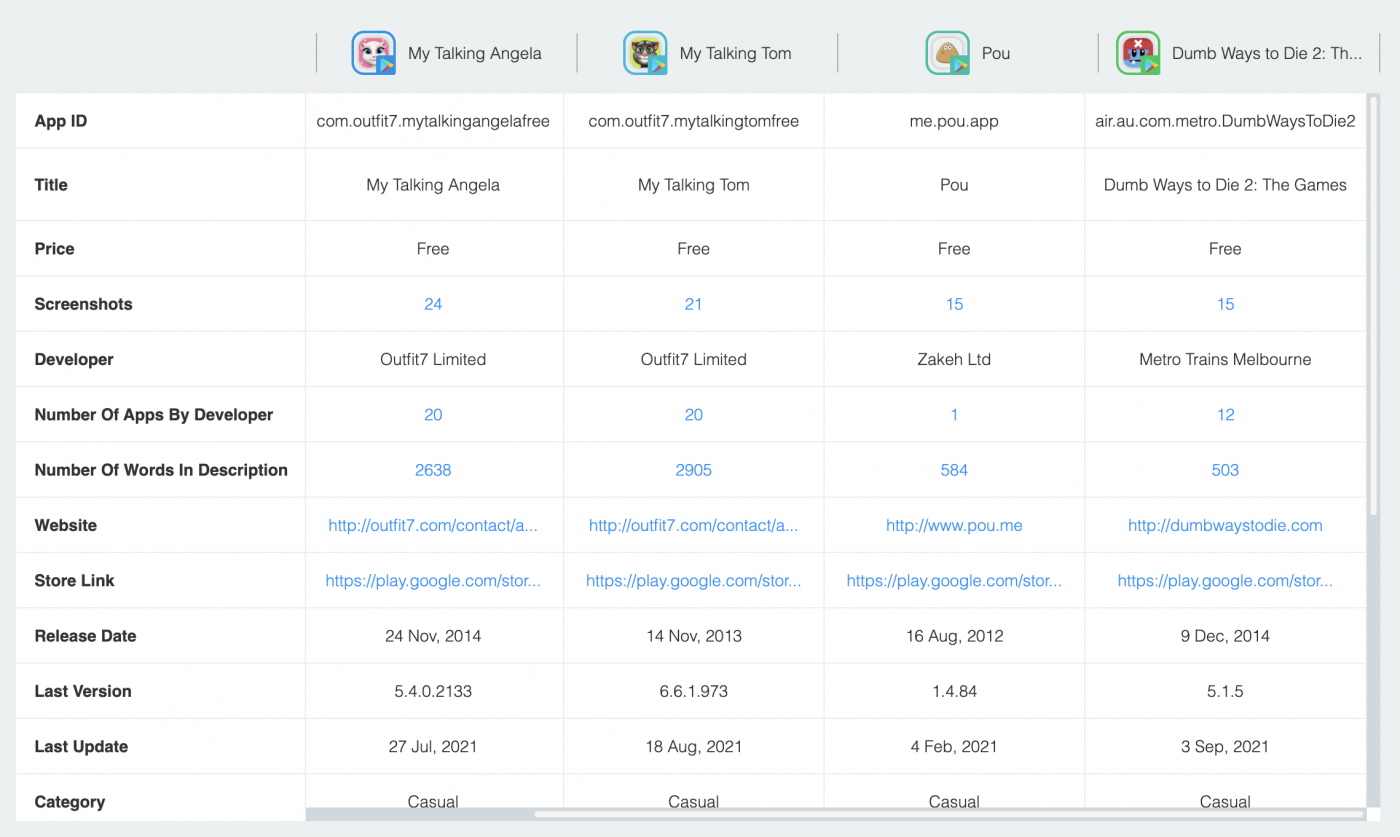

App Details

Last, but not least, app details. This chart compares app metadata, as well as other app and developer details. For instance: App ID, Title, Price, Developer, Number of Apps by Developer, Number of Words in Description, and much more.

Final Thoughts

It’s difficult to see past Candy Crush Saga’s dominance. Still, when one manages to do so, it becomes clear that hyper-casual games are actually hyper competitive.

As noted, My Talking Angela received 16.6 million downloads over the last 30 days. However, this was not enough for it to rank among the top 100 ‘Casual’ gaming apps in any country. A remarkable feat considering that Pou, which received just 7.8 million downloads over the same time period, cracks the top 100 in 103 separate countries.

Making things even murkier is the fact that King and Outfit7 Limited frequently update their apps. They’re constantly fixing bugs and rejiggering their content. Zakeh Ltd, meanwhile, revisited Pou just five times, and their performance has not evidently suffered for it.

So, while there are certainly some similarities between these apps (which SDKs they integrate, how well they’re rated by users, etc.), the truth is, building a highly successful hyper-casual mobile game requires a good deal of app intelligence.

Get Started With 42matters!

At 42matters, we provide app data, insights, analytics, and competitive intelligence via a host of useful APIs, file dumps, and the 42matters Explorer. This includes:

- Developer details

- Downloads

- Ratings, reviews, and top chart rankings

- Categories, genres, and IAB categories

- Technical insights, including SDKs, permissions, and app-ads.txt

- And more

The 42matters Explorer, which you can try free for 14 days, is an app market research tool that offers a comprehensive look at app trends and statistics. This includes data on both iOS and Android apps.

Moreover, our APIs facilitate programmatic access to app intelligence data from Google Play, the Apple App Store, Amazon Appstore, Tencent MyApp, and a host of connected TV app stores, including the Roku Channel Store, Apple TV tvOS App Store, Amazon Fire TV, Samsung Smart TV Apps, LG Content Store, and Vizio SmartCast Apps.

To learn more about 42matters, schedule a meeting with one of our app market experts. We'll walk you through everything.