Speaking at the 1983 International Design Conference in Aspen, Colorado, a 28-year-old Steve Jobs described a future in which consumers could purchase and download software directly from their computers. 25 years later, in 2008, Apple launched the Apple App Store, Google launched Google Play, and the mobile app economy was officially introduced to global markets.

In this article, we take a measuring stick to the mobile app landscape, analyzing where it stands 14 years after the debut of the world’s largest, most popular app stores. To make sure we’re all on the same page, we’ll begin with a brief definition of the app economy. Then, we’ll break down the current state of the app economy and app markets.

Here’s what we’ll focus on (click the links to jump to the corresponding section):

So, with that, let’s begin!

What is the app economy?

Put succinctly, the mobile app economy refers to the range of economic activities stemming from the development and distribution of mobile apps and games. The app economy includes device manufacturers, operating system developers, app distribution platforms (i.e. the Apple App Store, Google Play, etc.), mobile app and game publishers, software companies and API / SDK developers, ad networks and other mobile advertising companies, app data and analytics companies, and more.

What does the mobile app economy look like today?

According to Statista, the global app economy surpassed an estimated value of USD $6.3 trillion in 2021 (up from USD $3.3 trillion in 2019), with roughly USD $693 billion in annual revenue.

Of course, considering the impact Covid-19 had on 2020, all estimates should be taken with a rather sizable grain of salt. While the app economy was better positioned to weather the coronavirus storm than most industries, it wasn’t sunshine and rainbows for everyone. Ride-sharing, travel, and navigation apps like Lyft, Uber, AirBnB, and Waze were forced to make some difficult decisions during the pandemic.

Still, others flourished. Indeed, entertainment, video chat, news, health, and delivery apps have all experienced incredible growth. Notably, digital communications platforms like Microsoft Teams and Zoom; “Buy Now, Pay Later” (BNPL) apps like Chime, Klarna, and Afterpay; and commission free investment apps like Robinhood and WeBull have each had their moments in the sun.

Overall, the app economy has proven to be remarkably robust; and the successes of Microsoft Teams, Netflix, and Klarna appear to have been far more indicative of the future of the app economy than the momentary missteps of Airbnb, Uber, and Waze.

Consider this. According to Apple, in the period between April 2019 and September 2020, the iOS app economy managed to create 300,000 new jobs in the United States alone. Moreover, the App Store ecosystem now supports over 2.1 million jobs across all 50 states.

In any event, if we are to predict what the future holds with any accuracy, it’s important to understand the current state of the app economy and app markets. So, to begin our investigation, we’ll take a look at the most important mobile app distribution platforms — the app stores!

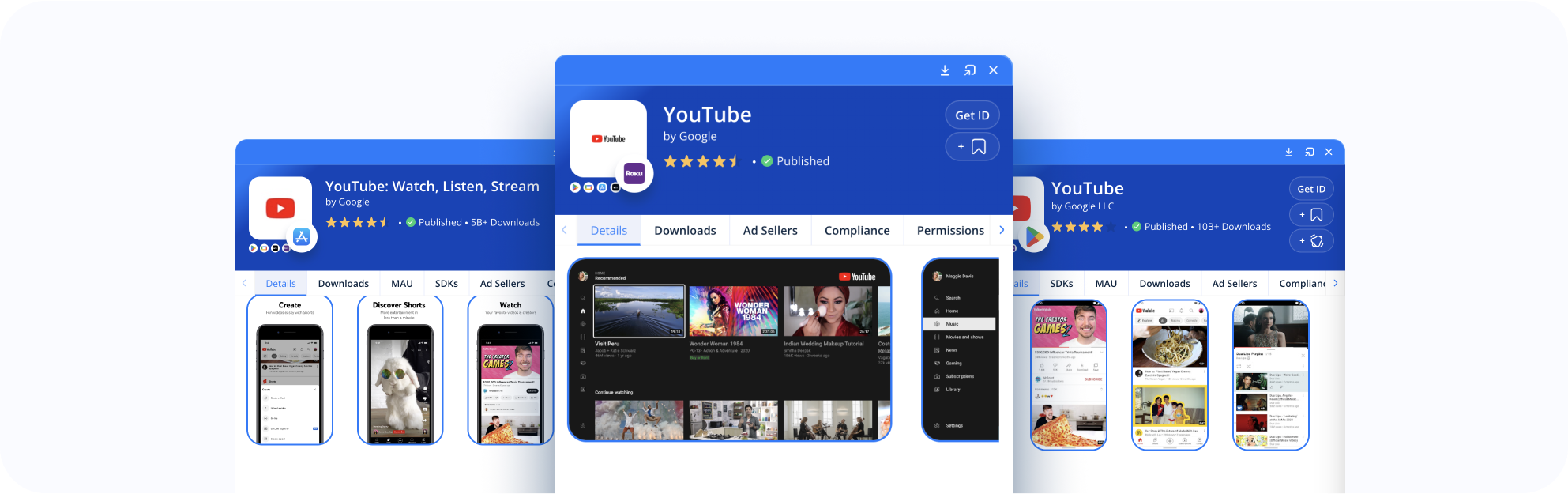

While the Apple App Store and Google Play remain the most popular places to download mobile apps and games, they are by no means the only places to do so. In addition to the big guys, we at 42matters track app market data from the Amazon Appstore and Tencent MyApp. We also provide insight into Connected TV (CTV) app stores, including the Roku Channel Store, Apple TV tvOS App Store, Amazon Fire TV, Google TV, Samsung Smart TV Apps, the LG Content Store, and Vizio SmartCast Apps. Let’s take a look at some of these individually.

1. Apple App Store

Following the success of the iTunes digital music store, the Apple App Store, which made its debut in 2008, became one of the world’s first commercially successful mobile app marketplaces. Today it connects millions of iOS device users to millions of mobile apps and games from developers and publishers all over the world.

How Many Apps Are on the Apple App Store?

The Apple App Store offers 1,727,204 apps.

How Many App Publishers Are on the Apple App Store?

728,858 app publishers have published their apps on the Apple App Store.

What Is the Distribution of Apps Versus Games on Apple App Store?

Of the 1,727,204 apps available on the Apple App Store, 218,225 are gaming apps and 1,508,979 are non-gaming apps.

How Many Apps Are Published on the Apple App Store per Day?

An average of 1,194 new apps are released on the Apple App Store every day.

2. Google Play

Launched in 2008, Google Play was a direct response to the Apple App Store, which had gone to market just a few months earlier. It serves as the official app store for the Android operating system, enabling users to browse and download mobile apps and games developed with the Android software development kit (SDK).

How Many Apps Are on Google Play?

Google Play offers 3,612,796 apps.

How Many App Publishers Are on Google Play?

1,079,911 app publishers have published their apps on Google Play.

What Is the Distribution of Apps Versus Games on Google Play?

Of the 3,612,796 apps available on Google Play, 497,321 are gaming apps and 3,115,477 are non-gaming apps.

How Many Apps Are Published on Google Play per Day?

An average of 2,012 new apps are released on Google Play every day.

3. Amazon Appstore

In 2011, following the success of companies like Google and Apple in the digital entertainment and mobile application space, Amazon launched the Amazon Appstore. It serves Android- and Fire OS-enabled devices, such as the Kindle Fire tablet and a host of BlackBerry products.

The Amazon Appstore now boasts a catalog of 778,654 mobile apps and games.

For more Amazon Appstore stats, check out our store stats pages.

4. Amazon FireTV

Amazon’s first Fire TV was launched in early 2014. It was the company’s response to the digital streaming trend that culminated in the Apple TV, Netflix, Hulu Plus, Roku’s various streaming devices and smart appliances, and more.

Currently, there are 16,376 apps available on Amazon FireTV.

For more Amazon FireTV stats, check out our store stats pages.

5. Apple TV tvOS App Store

Apple has been particularly innovative in the digital entertainment space. Building off the wild success of iTunes and the Apple App store, the company launched the Apple TV digital media player in 2007 and the tvOS operating system in 2015.

To date, the Apple TV tvOS App Store offers 19,298 apps.

For more Apple TV tvOS App Store stats, check out our store stats pages.

6. Roku Channel Store

The Roku connected TV revolutionized home entertainment. Founded in Los Gatos, California in 2002, their diverse catalog of products now covers everything from streaming devices, to smart TVs and high-end audio solutions.

However, their real moneymaker is the Roku Channel Store, which allows users to add their favorite “channels” to their Roku and Roku-powered devices in the same manner as the Apple App Store enables Apple device users to download their favorite apps across their entire profile.

The Roku Channel Store currently offers 32,240 apps.

For more Roku Channel Store stats, check out our store stats pages.

7. Tencent MyApp

Not only is Tencent the world's largest gaming company, they are also one of the world's largest social media companies and one of the world's largest venture capital firms and investment corporations.

In 2011, the company launched the Tencent MyApp, which was based on a reworked version of the company’s Tencent QQ, an instant messaging service and web portal. The new appstore facilitates the download of apps for Android, iOS, Symbian, and Windows devices.

Today the platform boasts a catalog of 24,582 mobile apps.

For more Tencent Appstore stats, check out our store stats pages.

8. Google TV

Just like Amazon, Apple, and others, Google has recently directed a good deal of attention towards the connected TV (CTV) and digital entertainment space. Google TV, which is essentially a revamped interface for Android TV, was released in 2020.

Today Google TV boasts a catalog of 6,754 mobile apps.

For more Google TV stats, check out our store stats pages.

Which Android app categories have had the best year? Which Android app categories have had the worst year?

Moving on, we’ll now take a look at which Android app categories have had the most success, as well as which have had the most trouble, over the last 12 months. These numbers are determined by the number of app downloads for each category.

The Best 5 Upward-trending Google Play App Categories by Downloads from 08/2022 – 09/2022:

So far, the “Medical” category has had the best year, registering a 32.74% growth in downloads. This is followed by “Business” at 15.87%, “Education” at 10.34%, “News and Magazines” at 8.53%, and “Art and Design” at 5.17%.

The 5 Most Downward-trending Google Play App Categories by Downloads from 08/2022 – 09/2022

Now for the categories that have struggled. “Libraries” took the biggest hit, registering a 34.15% decline in downloads. This was followed by “Comics,” which dropped by 32.05%; “Weather,” which dropped by 15.75%; “Parenting,” which dropped by 12.05%; and “Entertainment,” which dropped by 9.02%.

Which app developers are dominating global markets?

We’ve taken a look at some of the world’s largest app markets and ranked the top five Android developers based in each country. We’ve determined our rankings by estimating how many times their apps have been downloaded in total.

1. United States

1. Google LLC — 171 apps, 204.4+ billion downloads

2. Meta Platforms, Inc. — 21 apps, 17.5+ billion downloads

3. Microsoft Corporation — 88 apps, 12.5+ billion downloads

4. WhatsApp Inc. — 3 apps, 8.5+ billion downloads

5. Motorola Mobility LLC. — 65 apps, 6.4+ billion downloads

2. China

1. Xiaomi Inc. — 17 apps, 7.5+ billion downloads

2. Huawei Internet Services — 7 apps, 4.2+ billion downloads

3. Shalltry Group — 18 apps, 2.2+ billion downloads

4. UCWeb Singapore Pte. Ltd. — 3 apps, 1.5+ billion downloads

5. Mi Music — 1 app, 1.3+ billion downloads

3. India

1. Samsung R&D Institute India Noida — 9 apps, 2.1+ billion downloads

2. Smart Media4U Technology Pte.Ltd. — 3 apps, 2+ billion downloads

3. Jio Platforms Limited — 47 apps, 1.3+ billion downloads

4. Truecaller — 1 app, 1+ billion downloads

5. Airtel — 15 apps, 719.8+ million downloads

4. United Kingdom

1. SwiftKey — 2 apps, 1+ billion downloads

2. Badoo — 2 apps, 325.3+ million downloads

3. Wasabi — 181 apps, 184.7+ million downloads

4. IMDb — 2 apps, 171.5+ million downloads

5. Piriform — 1 app, 108.1+ million downloads

5. Germany

1. SoundCloud — 2 apps, 352.4+ million downloads

2. upday GmbH & Co. KG — 4 apps, 273.6+ million downloads

3. TeaCapps — 3 apps, 245.3+ million downloads

4. RARLAB (published by win.rar GmbH) — 1 apps, 169+ million downloads

5. TeamViewer — 208 apps, 161+ million downloads

For the latest country-specific app publisher insights, check out our website.

Which apps are dominating global markets?

On to the apps! We’ve ranked the five most popular Android apps, in terms of estimated total downloads for five of the largest global app markets.

1. United States

1. Amazon Prime Video — Amazon Mobile LLC

2. TikTok — TikTok Pte. Ltd.

3. Filto: Video Filter Editor — Pinso.Inc

4. WhatsApp Messenger — WhatsApp LLC

5. CashApp — Square, Inc.

2. China

1. Twitter — Twitter, Inc.

2. Telegram — Telegram FZ-LLC

3. YouTube — Google LLC

4. Instagram — Instagram

5. Google — Google LLC

3. India

1. Flipkart Online Shopping App — Flipkart

2. Meesho: Online Shopping App — Meesho

3. Amazon India Shop, Pay, miniTV — Amazon Mobile LLC

4. Instagram — Instagram

5. Shopsy Shopping App - Flipkart — Shopsy

4. United Kingdom

1. ASDA Rewards — Asda Stores Ltd

2. McDonald’s UK — McDonald’s UK

3. Google Wallet — Google LLC

4. Disney+ — Disney

5. Microsoft Teams — Microsoft Corporation

5. Germany

1. TikTok Now — TikTok Pte. Ltd.

2. PENNY Angebote & Coupons — PENNY Markt GmbH

3. VR Banking - Deine mobile Bank — Atruvia AG

4. Takko Friends — Takko Holding GmbH

5. PayPal - Send, Shop, Manage — PayPal Mobile

For the latest country-specific app market statistics, be sure to visit our website.

Which SDKs are integrated in the most apps?

Last, but certainly not least, SDKs! Short for Software Development Kits, SDKs play an important role in the mobile app ecosystem, enabling everything from app monetization to app development.

At 42matters, we track 2,300+ SDKs across 13 different SDK categories. So, we’ve ranked the most popular Android SDKs, in terms of market share, for 10 of these categories. Here are the top three SDKs for each:

1. Ad Network

1. Google Ads AdMob — Google LLC

2. Facebook Audience Network — Facebook

3.Google Mobile Ads Consent AdMob SDK — Google LLC

2. Analytics

1. Google Firebase — Google LLC

2. Firebase Crashlytics Fabric — Google LLC

3. Google Analytics — Google LLC

3. Attribution

1. AppsFlyer — AppsFlyer

2. Yandex App Metrica — Yandex

3. Adjust — Adjust

4. Commerce

1. Google Play In-app billing — Google LLC

2. Razorpay — Razorpay

3. Stripe — Stripe

5. Communication

1. OneSignal — OneSignal

2. gRPC — gRPC

3. WebRTC — WebRTC

6. Marketing Automation

1. Intercom — Intercom

2. Freshchat Freshdesk Messaging by Freshworks — Freshworks

3. WebEngage — WebEngage

7. Data Intelligence

1. StartApp - TrueNet Network and Speed Info — StartApp

2. AltBeacon by Radius Networks — Radius Networks

3. SafeDK — SafeDK

8. Backend

1. Google Firebase — Google LLC

2. Sentry — Sentry

3. Microsoft Visual Studio App Center — Microsoft Corporation

9. CRM

1. Intercom — Intercom

2. Auth0 — Auth0

3. Tobit — Tobit

10. Social

1. Facebook — Facebook

2. Google Play Game Services — Google LLC

3. Fabric— Google LLC

To learn more about these and other SDKs, be sure to check out the 42matters SDK Explorer!

Want to do your own research on the state of the app economy?

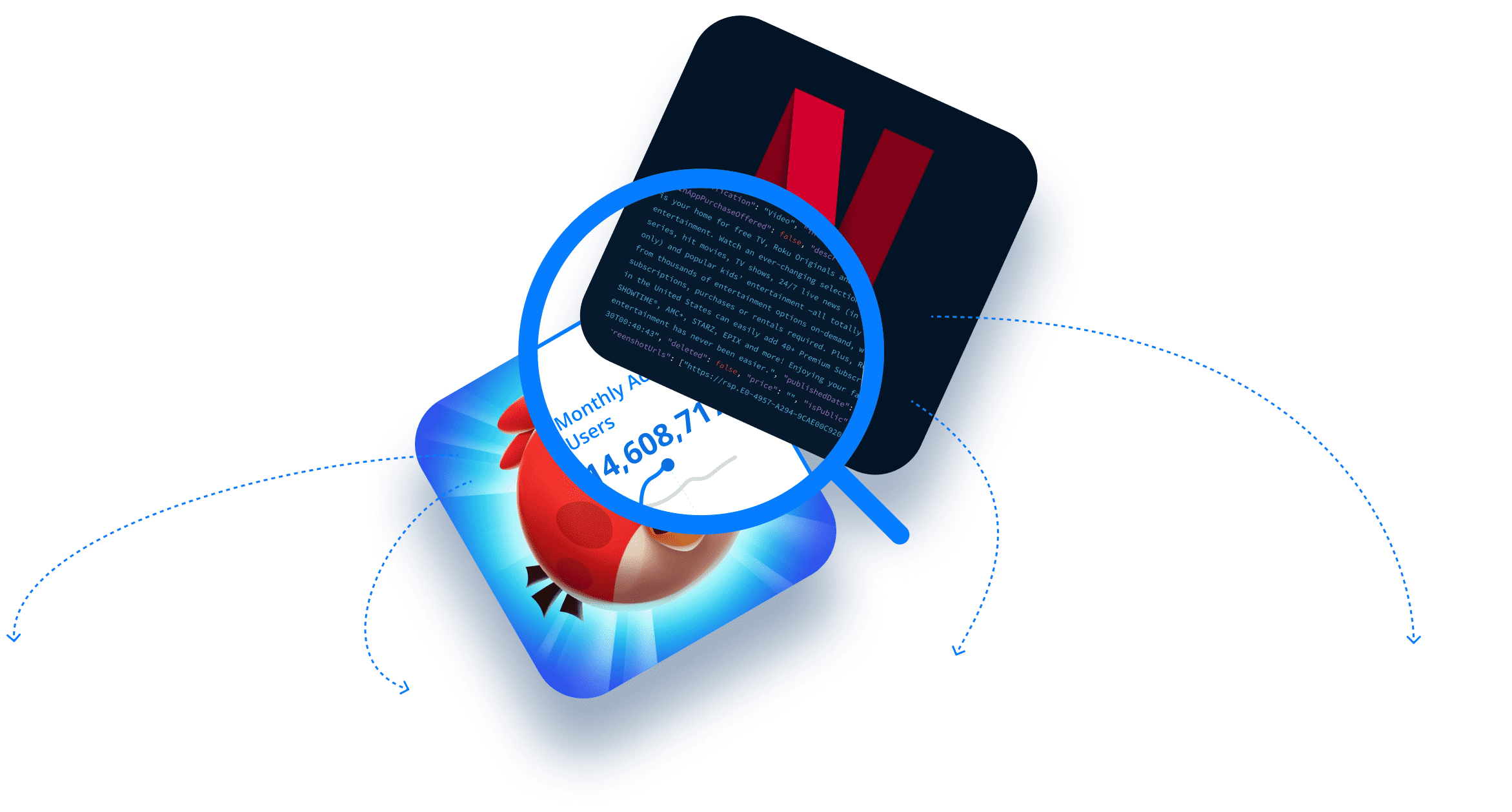

42matters has your back. We provide app insights, data, and analytics via a host of useful APIs, file dumps, the 42matters Explorer, the 42matters SDK Explorer, and the 42matters App Watchlist.

The Explorer, which is free for 14-days, is an app market research tool that provides a comprehensive look at app market trends and statistics. This includes in-depth, visual insights into app download trends, categories, IAB categories, metadata, rating and review analyses, and more. You can also download this data as a CSV and leverage it however you like — in your own algorithms, analyses, products, studies, etc.

Along the same lines, you can use our file dumps to examine and deploy raw app market data. These are hosted on AWS S3 and come in the form of a multi-line JSON file.

To learn how 42matters can help you stay informed on the state of the app economy, schedule a free demo with one of our experts.